Part One: The Crime that Has Been Hidden

The crime hasn't been entirely hidden, because clear signs of it show up in America's monetary statistics:Bud Conrad, who outperformed all but 27 other economists in the world and accurately predicted as early as 2006 the coming housing-bubble collapse, by announcing "The housing boom is over, but the story of the housing boom isn't," now is out with a terrific article published March 10th at Seeking Alpha, concerning "The Coming Crash in the Bond Market," in which Conrad documents a number of (as will be made clear here) important economic facts (and you can see there the charts displaying them):

Total debt in the U.S. reached around 380% of U.S. GDP in 2008, which was the highest such ratio in U.S. history, exceeding the previous top, which was 300%, reached at the very bottom of the Great Depression in 1933. (It's now back down to 350% - still above the 1933 peak.)

The federal government's debt continues to rise, but the debts of all other economic sectors have stopped rising, and have stayed virtually flat since 2008. (Incidentally, the reason why the federal government's debt is still rising is that the 2008 crash decimated the tax-revenues coming into the U.S. Treasury; the reason is not that federal spending soared - federal spending actually stopped soaring when Barack Obama came into the White House; the Republican accusation to the contrary was a blatant lie, nothing more.)

The Fed is printing money like crazy "to distort the [interest] rate to zero by extending its monthly purchases of $40 billion of mortgage-backed securities (MBSs) and $45 billion of Treasuries out to 2016," after which time (and that will be the end of Obama's second term), all hell might break loose, just as had happened at the end of GWB's Presidency - but, by then, it'll be the following President's problem.

And Conrad shows that it's not happening just in the United States: the central banks of all major economies are similarly sopping up the "toxic assets" that the banksters had created and sliced and diced and sold off to investors around the world, during the lead-up to the 2008 crash. Thus, while aristocrats thrive, everyone else faces increasing hardship: "austerity," "fiscal consolidation," "sequester," whatever form it takes in order to transfer the aristocracy's losses onto the public.

Certainly in the U.S. under Obama, the banksters get to keep their billions, even if they had demanded massive systemic fraud by their employees in order to "earn" it - and even though some had whistleblowers fired in order to hide what was going on. Obama met privately with the banksters on 27 March 2009 and told them, "My administration ... is the only thing between you and the pitchforks." He made clear at the very start of his Administration that he was out to protect them; not to prosecute them. In Obama's view, people such as the Democratic Massachusetts U.S. Senator Elizabeth Warren, who want elite financial crimes to be prosecuted instead of merely fined (as Obama has been doing), are like the KKK in the Old South, the people who lynched Blacks there. So, banksters, and their counterparties and major investors, are doing just fine, under Obama. But below the top 1%, the story is very different.

The reason that the Fed is sopping up all those "toxic assets" from the U.S. Treasury is in order to get this garbage off the balance sheets of the mega-banks, which in 2008 had been left holding the bag on their unsold inventory of this garbage that they had created, once global investors were no longer willing to buy it. It's like a food-maker that suddenly can't sell their output, once the public comes to know that it's "toxic."

Unlike such a food-maker, however, the mega-banks (and their counter-parties, and the controlling investors in their stocks and bonds) have such clout in Washington, that they are treated there as being a virtual royalty, Too Big To Fail (TBTF), and so the U.S. Treasury has been giving the mega-banks 100 cents on the dollar for their toxic assets, and has then been sending $40 billion of that garbage each month (at terms that are not publicly disclosed) to the Fed, which becomes the ultimate dumping-ground for it.

However, the Fed creates America's money, and so the toxic assets - these bum mortgage-backed securities - are being purchased from the Treasury with dollars that are, essentially, created by the Fed as mere electronic entries onto their balance sheets, so that the U.S. Treasury can then claim that what they had bought from Wall Street they have now sold off, and that they had thus served as nothing more than middle-man for this junk, just transfer-agents for it, like Timothy Geithner claimed.

That's the monetary economy. But two-thirds of the $1.54 trillion "Total Outstanding" to the Federal Government, and 58% of the monstrously large $13.87 trillion "At-Risk" to the Federal Government, on the "Total Wall Street Bailout Cost," are due to be repaid to the U.S. Treasury for future U.S. taxpayers from the Federal Reserve. And that's where the monetary economy will inevitably intersect with the real economy - real wealth - because there will be no real wealth, just electronic entries, available from the Fed, to make some or all of those payments, when they come due to the Treasury.

This is called cheapening the dollar: it's inevitably causing the dollar itself to be backed by less wealth. The aristocracy's bum MBSs become ours - everybody's - even while the people who ordered them to be created (and marketed with deceit) get to keep "their" billions, and do not go to prison, even if that's where they actually belong.

In other words: the Federal Government is "inflating" its way out of the 2008 crash, but this is being done secretly; and part of keeping it secret is keeping these people's crimes out of the criminal courts.

We don't see "inflation" around us, do we? Here's why: When inflation is pent up for years and hidden from the public, like is happening now, and like happened to Germany after the Versailles Treaty that had ended WWI, it explodes suddenly upon the public, and that's called "hyper-inflation": it's the result of hiding inflation until it cannot be hidden any longer. In Germany, it enabled the conservative extremists, fascists, to come to power there, setting the majority against minorities; and so America's conservative Republican Party, and especially its extremist conservatives, might reasonably see this as being their ultimate path to power. But supporters of democracy in America can only be terrified by the prospect. Conservative extremism isn't democracy; it's just organized mob-rule, government in which the aristocracy that controls the mega-banks and the large corporations pulls the economic strings behind the scenes, manipulating the public to accept rule by this elite. It's crony capitalism; it's not any authentically free market.

Here is how it is already showing itself, in the real economy - the distribution of wealth. While stocks have soared since Obama came into office, wages have declined 5% (after having already declined in Bush's last two years, down 7% during 2007 and 2008), and inequality has soared. On 23 January 2013, Emmanuel Saez headlined "Striking It Richer: The Evolution of Top Incomes in the United States (Updated with 2011 estimates)," and he buried in his paper this stunning finding: "The top 1% captured 121% of the income gains in the first two years of the recovery." What the data were showing was that for the first time ever on record, all income gains went only to the top 1%. The bottom 99% lost 0.4% in income during Obama's economic recovery from Bush's crash. The bottom 99% were even a bit worse off now than they were under Bush's crash. But the top 1% were 21% better-off now than they were when Obama took office.

On 2 October 2012, Bloomberg News headlined "Top 1% Got 93% of Income Growth as Rich-Poor Gap Widened," and Peter Robison reported that, "The earnings gap between rich and poor Americans was the widest in more than four decades in 2011, Census data show, surpassing income inequality previously reported in Uganda and Kazakhstan," both of which countries are well recognized to be plutocracies. The reason for this yawning gap is that when Geithner structured the bailout of Wall Street, he insisted that future U.S. taxpayers would be obliged to bail out the then-current bondholders in those bailed-out firms at 100 cents on the dollar, as if there were no "toxic assets" at all being held by those firms (which had actually been bankrupted by the toxic assets that remained on their books after the music stopped and so they could no longer find buyers for the corrupt MBS securities they had produced). Shahien Nasiripour at Huffington Post bannered, on 16 May 2011, "Confidential Federal Audits Accuse Five Biggest Mortgage Firms Of Defrauding Taxpayers," and he reported that the Inspector General of the U.S. Department of Housing and Urban Development had carried out audits of Bank of America (NYSE:BAC), JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), and Ally Financial, and found, in each case, that they had swindled the Federal Government. "The internal watchdog office at HUD referred its findings to the Department of Justice, which had to decide whether to file charges" under "the False Claims Act, a Civil War-era law crafted as a weapon against firms that swindle the government." All of "the audits conclude that the banks effectively cheated taxpayers by presenting the Federal Housing Administration with false claims: They filed for federal reimbursement on foreclosed homes ... using defective and faulty documents." Obama's "Justice" Department refused even to prosecute, much less to pursue, any of these mega-crooks, who had cheated the U.S. Government - ultimately taxpayers.

Under Obama, Bush's soaring inequality of both income and wealth in this country has continued, so that we now have a situation in which virtually everyone except the top 1% are sinking. The stock markets break record highs, while the real economy sinks deeper down toward despair. And this is the reason why: Obama doesn't believe in executive immunity only for his predecessor George W. Bush and himself, but also for banksters and other elite criminals.

Barack Obama makes a mockery of the Equal Protection Clause in the U.S. Constitution. That former Constitutional-law scholar proves himself to be the supreme master of hypocrisy. As a result, the people of the United States have not gotten from this Administration the massive economic-recovery investments in roads, bridges, and other infrastructure, and in education and public health, that would have put Americans constructively back to work and caused unemployment to plunge, such as happened under Franklin Delano Roosevelt; instead, we unconstructively bailed out the aristocracy, and so luxury goods are selling like hotcakes, while homelessness and poverty mushroom.

Part Two: Economists Worry Because White House & CBO Projections Cook the Books

Matthew Boesler of Business Insider headlined on 4 March 2013, "The Fed Is Starting To Prepare For A Future PR Nightmare," and he reported on the mounting concern among economists regarding how the Federal Reserve is going to "unwind the $3 trillion balance sheet amassed from years of quantitative easing." But what Boessler was really talking about there (without quite saying so) is the problem of how the entire U.S. Government is going to "unwind" from cooking its books - a problem that has come to the fore only in recent weeks, because of an important recently-issued analysis of the U.S. federal budget.This cooking-of-the books is actually not just at the Federal Reserve; it's also at the White House, and Congress. For example, the Congressional Budget Office's "The Budget and Economic Outlook: Fiscal Years 2013 to 2023" projects (e.g.: pages 5, 41, 42 & 48) that long-term (10-year Treasury bond) interest rates will rise gradually to reach a level of 5.2% in 2018 and then suddenly and forever afterward will remain constant at that level for at least the following five years. Without such a basic assumption, the entire federal budget would collapse (as they show).

The Federal Reserve's part of it is that when the Fed finally stops its easy-money policies, which have been undertaken in order (supposedly) to restore the U.S. economy after the 2008 economic crash (but actually in order to transfer their losses to the public), the Fed's enormous portfolio of U.S. Treasury bonds, which they have been buying in order to enable the U.S. Treasury to sop up the mega-banks' "toxic assets" and transfer that collateral onto future U.S. taxpayers, will steeply lose value, because (even irrespective of the trash that stands behind them) the average maturity of those bonds is long, 10 years, and because bonds that have such long maturities decline sharply in value whenever inflation rises.

The Fed's expected-but-not-projected PR Nightmare will occur when this happens; and so, they have been doing everything they can to delay it for as long as they can.

That is why an influential recent paper from four economists has sparked concern among Fed-watchers. Titled "Crunch Time: Fiscal Crises and the Role of Monetary Policy," its authors include Frederic Mishkin, Ben Bernanke's former right-hand man; and they point out that, "The CBO's baseline estimates (and similar projections produced by the White House Office of Management and Budget) assume that long-term interest rates rise gradually to reach a level of 5.2% in 2018 and then remain constant at that level despite an assumed continued escalation in the amount of public debt outstanding." In other words, they openly say that the Federal budget has no clothes.

Thus, the U.S. Government is basing its forecasts upon an unrealistic assumption that the U.S. Government's long-term interest-rates can never rise above 5.2%, even as the Government's debt, and debt/GDP ratio, soar (from $16 trillion, to a projected $20 trillion during just 2018-2023). U.S. Treasury bonds have occasionally needed to pay far higher than a 5.2% interest-rate in order to be able to attract investors. So: why would the world's investors not continue to demand increasing interest-rates from such a decreasingly-solvent debtor as this?

In other words: Beyond 2018, the U.S. is likely to face, as the authors put it, "an adverse feedback loop in which doubts by lenders lead to higher sovereign interest rates which in turn make the debt problems more severe."

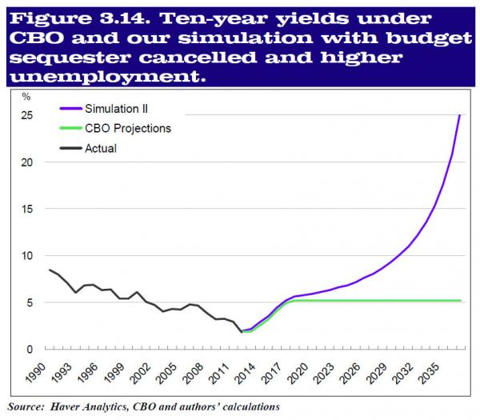

Rumbling in the background of this study is their warning of "tipping-point dynamics" that could produce runaway and uncontrollable inflation. Their model, however, lacks any such "tipping point," and simply produces a smooth graph (below), which shows that "Actual and Projected 10-Year Bond Yields Under CBO Assumptions and Our Baseline Assumptions" diverge radically from 2018 onwards, so that by 2040, 10-year Treasuries will need to be paying a 10% interest-rate, as compared with the CBO-projected constant 5.2% rate after 2018. Their study is based upon very conservative (optimistic) assumptions, such as that Washington will quickly resolve its fiscal battles, and that unemployment will increase again, which will drive inflation down and therefore help prevent the need for the U.S. Treasury to increase above 5.2% the interest-rate it offers on its 10-year bonds. Here is their chart showing their model, as compared to the CBO and White House model, under these favorable assumptions:

(click to enlarge)

Even this projection is probably too optimistic, however, because: "We have assumed the U.S. current account deficit holds at 2.5% of GDP - a level that matches the best result seen in the past decade. ... If, instead, we assume that the current account deficit reverted to the 3.7% of GDP average seen over the prior five years, then the projected debt burden would reach 180% in 2037," about the time that long-term Treasuries would probably pay interest-rates around 10%. This study notes the likelihood of a "Lehman moment" occurring soon in the EU, but it says, "The Euro area's overall fiscal path looks a good deal more benign than that of the U.S." And, "The US federal fiscal picture is bleaker than Europe's."

Most of the establishmentarian opponents of this study (and you can find them on the Web, at places such as The New York Times, and from Fed officials) cite especially the case of Japan, which has sustained low interest rates throughout decades of stagnation. However, as the Mishkin et al. study itself points out, "In comparison to the Fed, the Bank of Japan and ECB, both of which have expanded their balance sheets [i.e., bought the aristocracy's toxic assets] to several times their pre-crisis levels, have kept the duration of their portfolios much lower - on the order of three years," as compared with the Fed's average 10-year maturities. The U.S. economy is thus much more brittle than Japan's was.

So, basically, another Great Depression seems to be predicted here. According to their model, it will probably happen after the interest-rate on 10-year Treasuries rises above 5.2%, when the unrealism of current official projections has become sufficiently clear to the world so that the federal debt resumes soaring and the interest-portion of federal expenditures rises similarly. That would be some time after 2018.

The scenario projects that when this happens, international trade-protectionism will mushroom, as all major economies join in a currency-race to the bottom, so as to be able to keep their factories humming and their trade-balances positive in globally declining economic times.

A good summary of this paper has been presented in Britain's Telegraph on February 24th; Ambrose Evans-Pritchard headlines there "Trade Protectionism Looms Next as Central Banks Exhaust QE [monetary explosions and ZIRPs]." He closes: "The four years of QE have given us a contained depression." However, unfortunately, the longer it is "contained" in this way, the worse it will be when it comes. (Those average 10-year maturities in the U.S. mean that once inflation starts here, it could become uncontrollable faster than in the other developed countries. This is the reason the Mishkin et al. paper says that the U.S. is in the worst position of them all.

CONCLUSION

Monetary policy is being used to make up for, or actually to hide the effects of, President Obama's being more concerned about restoring Wall Street than about restoring Main Street. The Fed is using the tool that is under its command, monetary policy, in order to make up for Obama's having disbelieved his economists, who, when he came into office, told him that a much bigger stimulus would be needed in order to recover from Bush's crash. According to Ron Suskind's 2011 Confidence Men, and other sources, Obama didn't accept what Democratic economists were telling him; he believed the view of many Republican economists (and somewhat accepted by Larry Summers, one of Obama's two top economists), that high unemployment was due to high worker-productivity and was therefore largely a good thing; he rejected the idea of Democratic economists, that it was necessarily a bad thing which should be his top economic priority to overcome. Consequently, the Federal Reserve has increasingly been taking on the burden to do with monetary policy what Obama and Congress ought to have been doing with their fiscal policy: put people back to work.We are seeing the failing results from using monetary policy in order to do what only fiscal policy is suitable, long-term, to do: restore demand in the economy after a crash.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment